Building the Next Generation of Industrial Compounders

Our Investment Focus

Arcline is a growth-oriented private equity firm with over $20 billion in assets under management.

We build enduring industrial platforms by bringing together niche, mission-critical suppliers in resilient markets. We invest in businesses with persistent demand, limited disruption risk, and fragmented industry structures to support meaningful consolidation.

Our view is generational, not transactional.

Our Portfolio

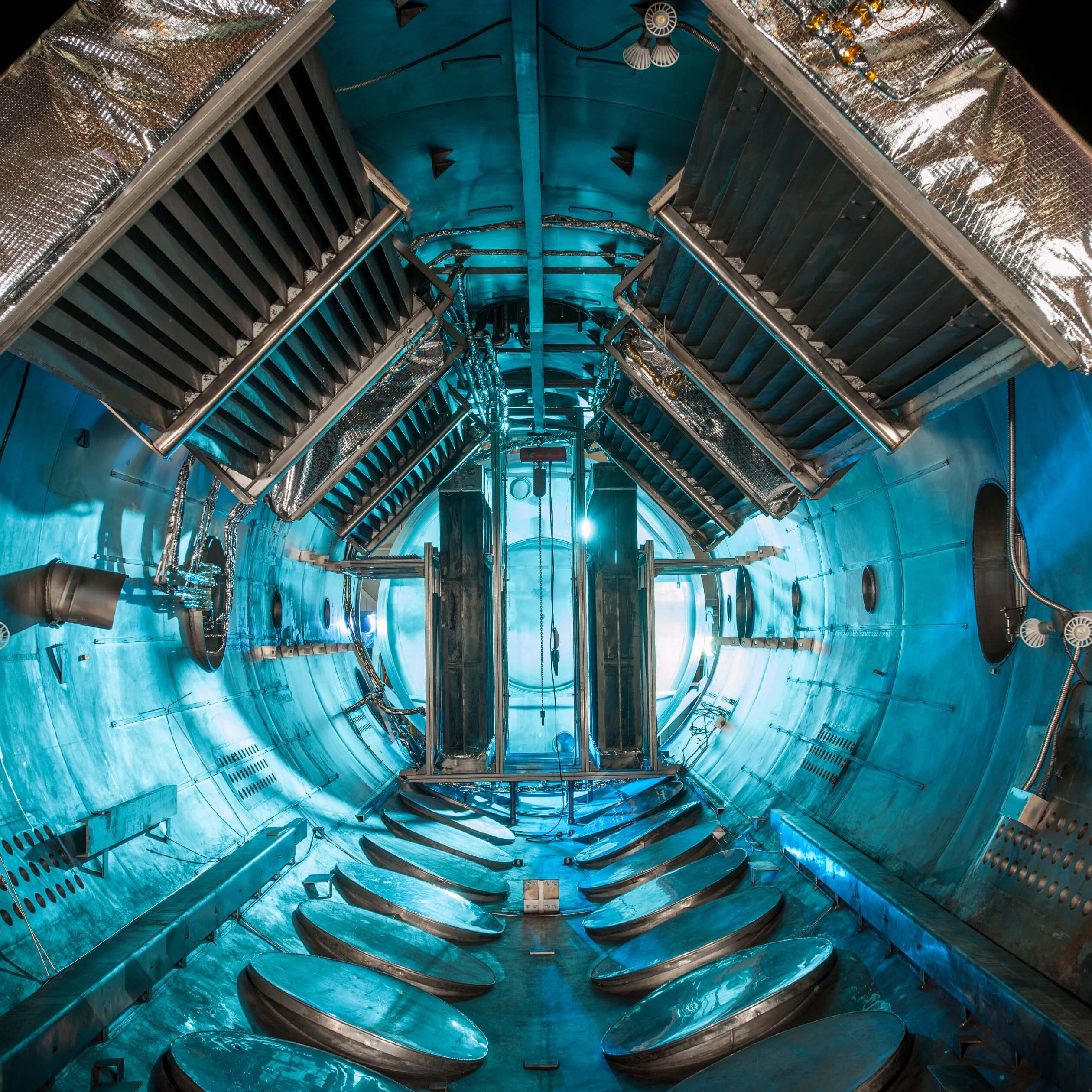

We compound earnings over the long term through strategic M&A, operational rigor, and disciplined capital allocation rather than short-term financial engineering. Since 2018, we have formed our portfolio through 160+ acquisitions and built scaled platforms in aerospace and defense, engineered components, critical infrastructure, and test and measurement—all sectors defined by mission-critical performance, high-switching costs, regulatory barriers and long product lifecycles.

Select investments include:

- All

- Active

- All

- Aerospace & Defense

- Energy Transition

- Health & Safety

- Life Sciences

- Semiconductors

- All

- Critical Infrastructure Machinery

- Engineered Components

- Industrial Technology

- Measurement & Monitoring

- Specialized A&D Systems

- All

- Europe

- USA - East

- USA - Mid

- USA - West

Engineered Components

,USA - West

,Active

Engineered Components

,Active

Engineered components for mission-critical applications

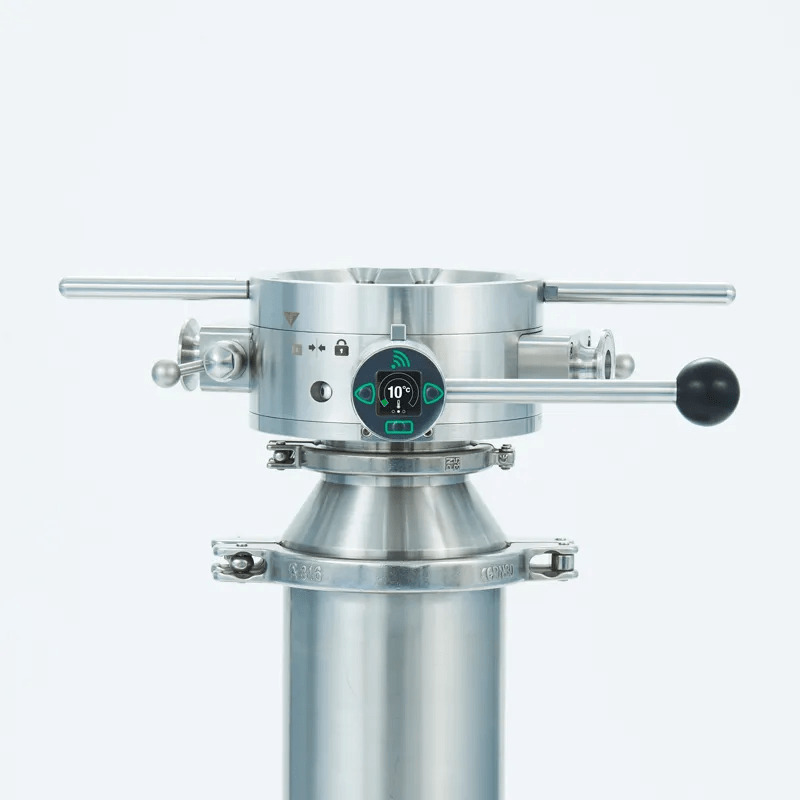

Life Sciences

,Industrial Technology

,Europe

,Liverpool, UK

,Active

Proprietary safety equipment and consumables used in pharmaceutical manufacturing

Energy Transition

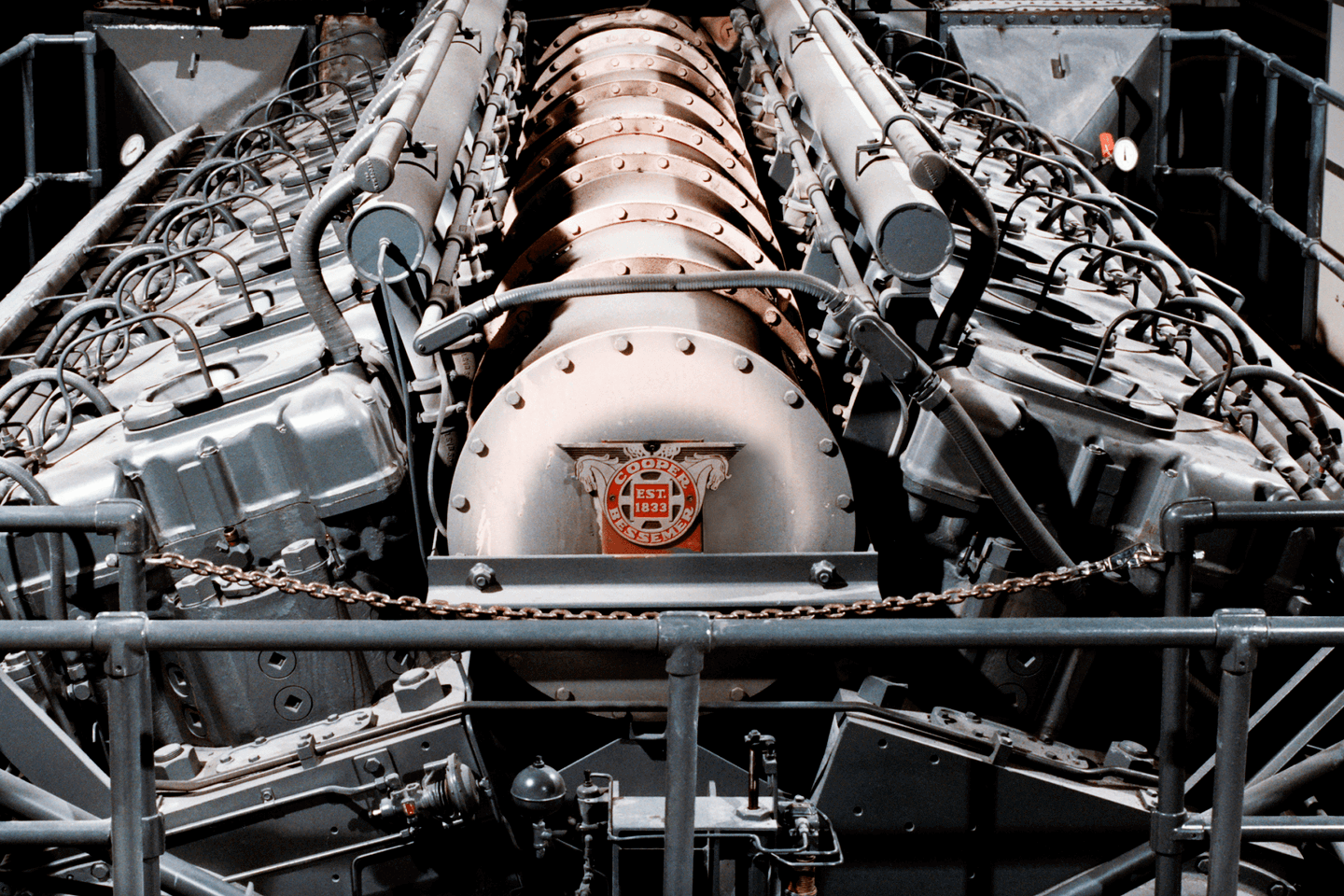

,Critical Infrastructure Machinery

,Houston, TX

,USA - Mid

,Active

OEM and aftermarket solutions for critical natural gas transmission infrastructure

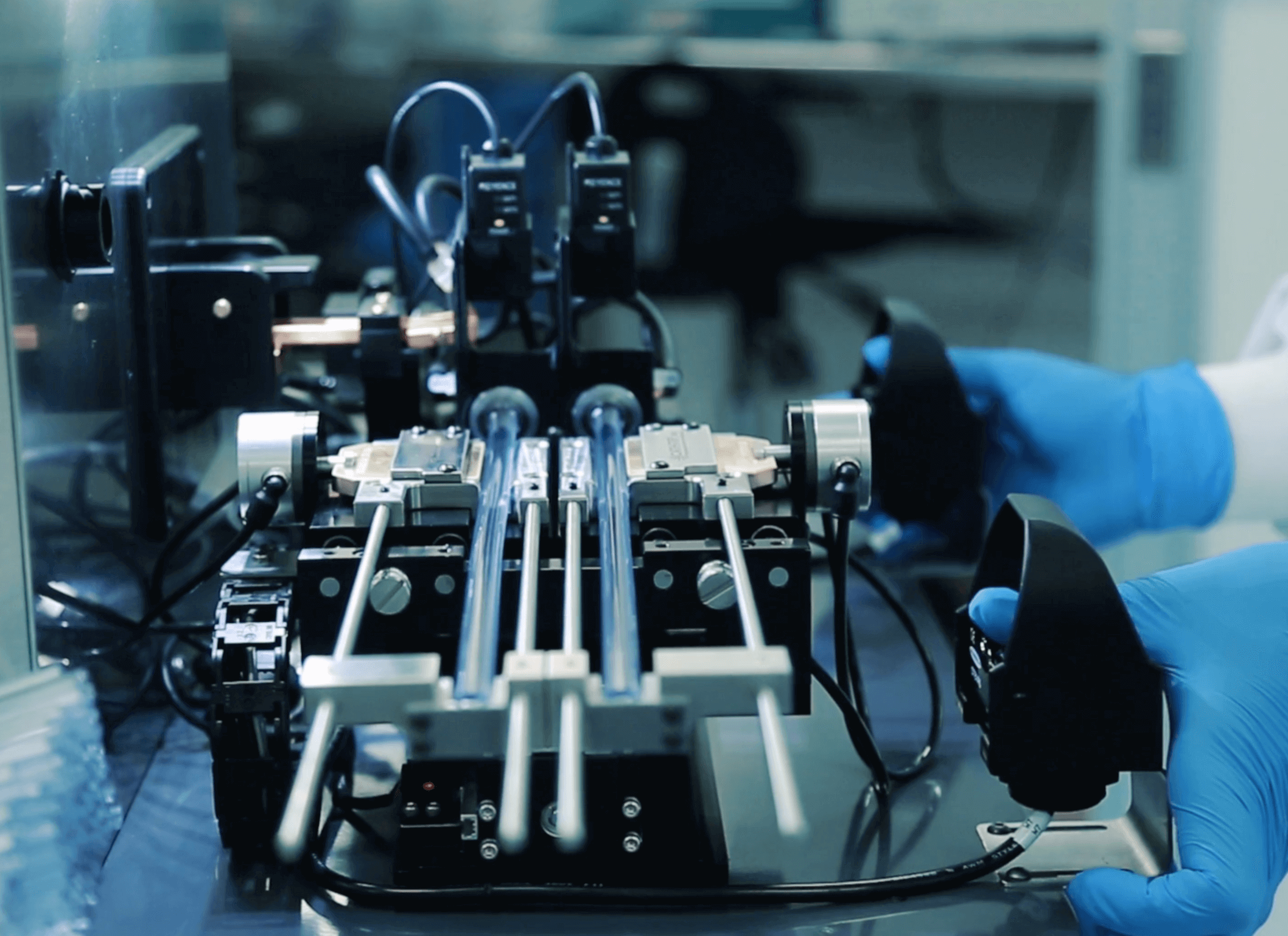

Semiconductors

,Industrial Technology

,Europe

,Tilburg, NL

,Active

Leading designer and manufacturer of flexible gas and flow control components and systems

Health & Safety

,Measurement & Monitoring

,Michigan City, IN

,USA - Mid

,Active

Leading provider of proprietary, specialty sensing and instrumentation technology

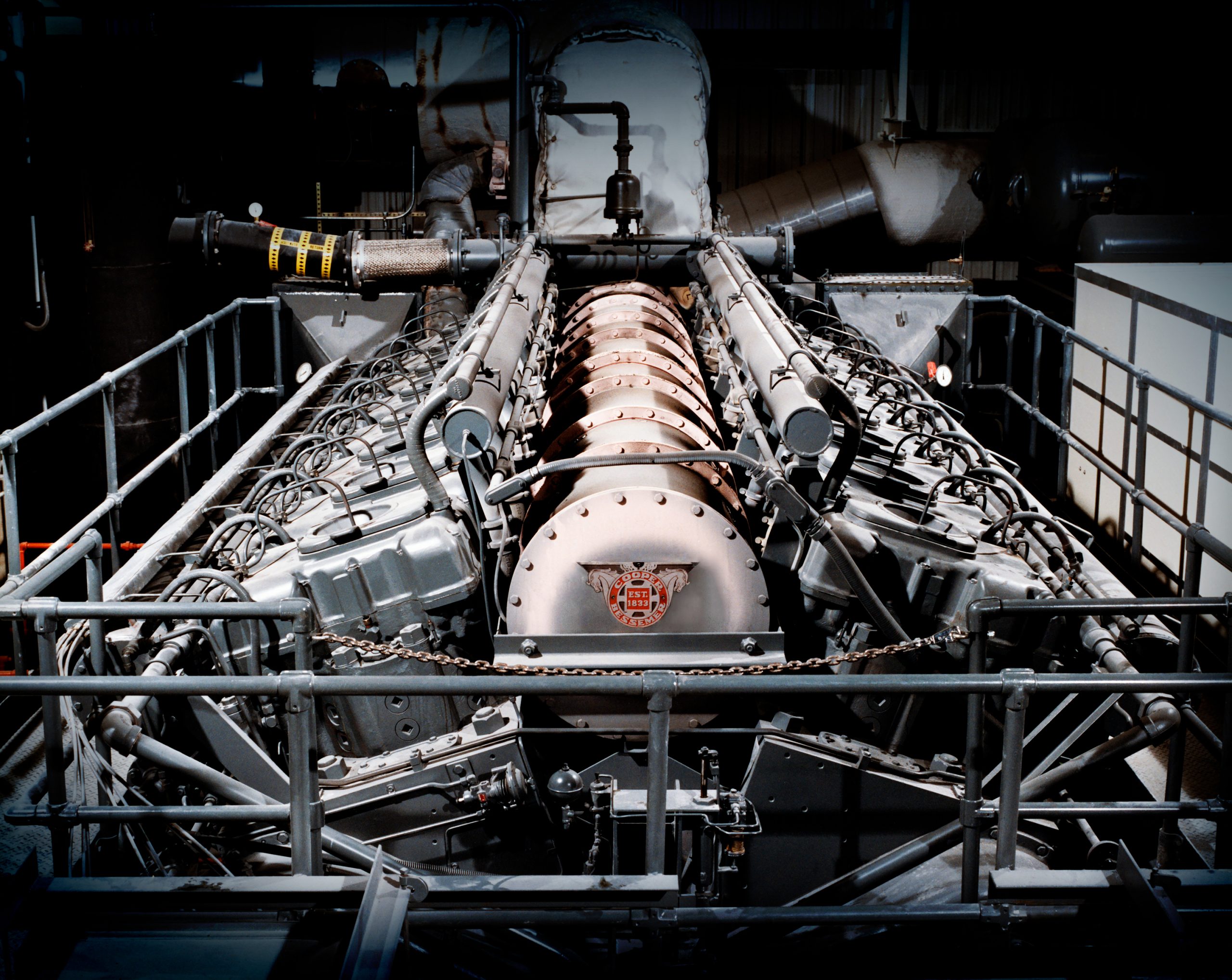

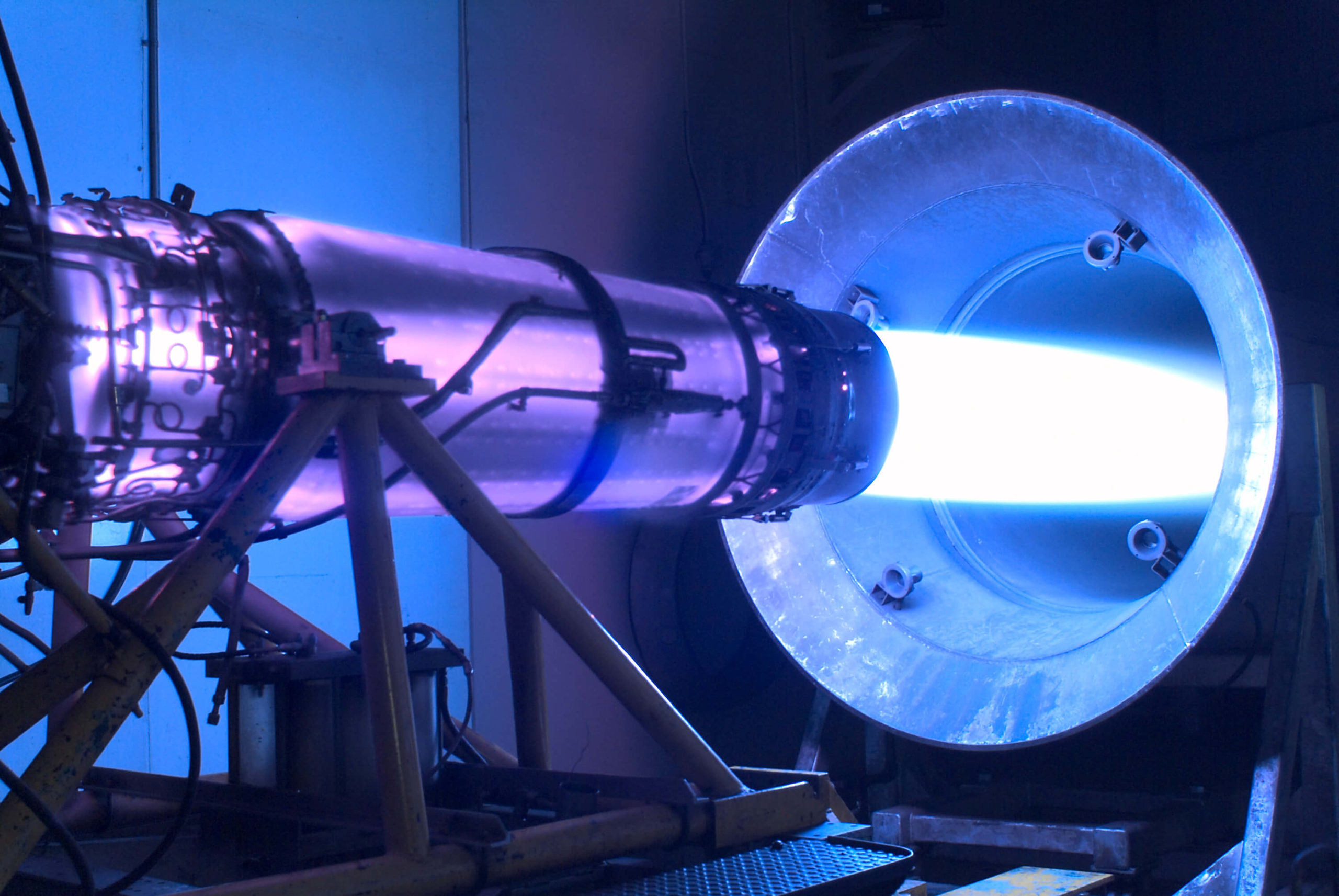

Aerospace & Defense

,Critical Infrastructure Machinery

,Beloit, WI

,USA - Mid

,Active

OEM and aftermarket solutions provider of critical systems to the US and allied Navies around the world

Health & Safety

,Industrial Technology

,Coppell, TX

,USA - Mid

,Active

Leading provider of emergency communication and remote monitoring solutions

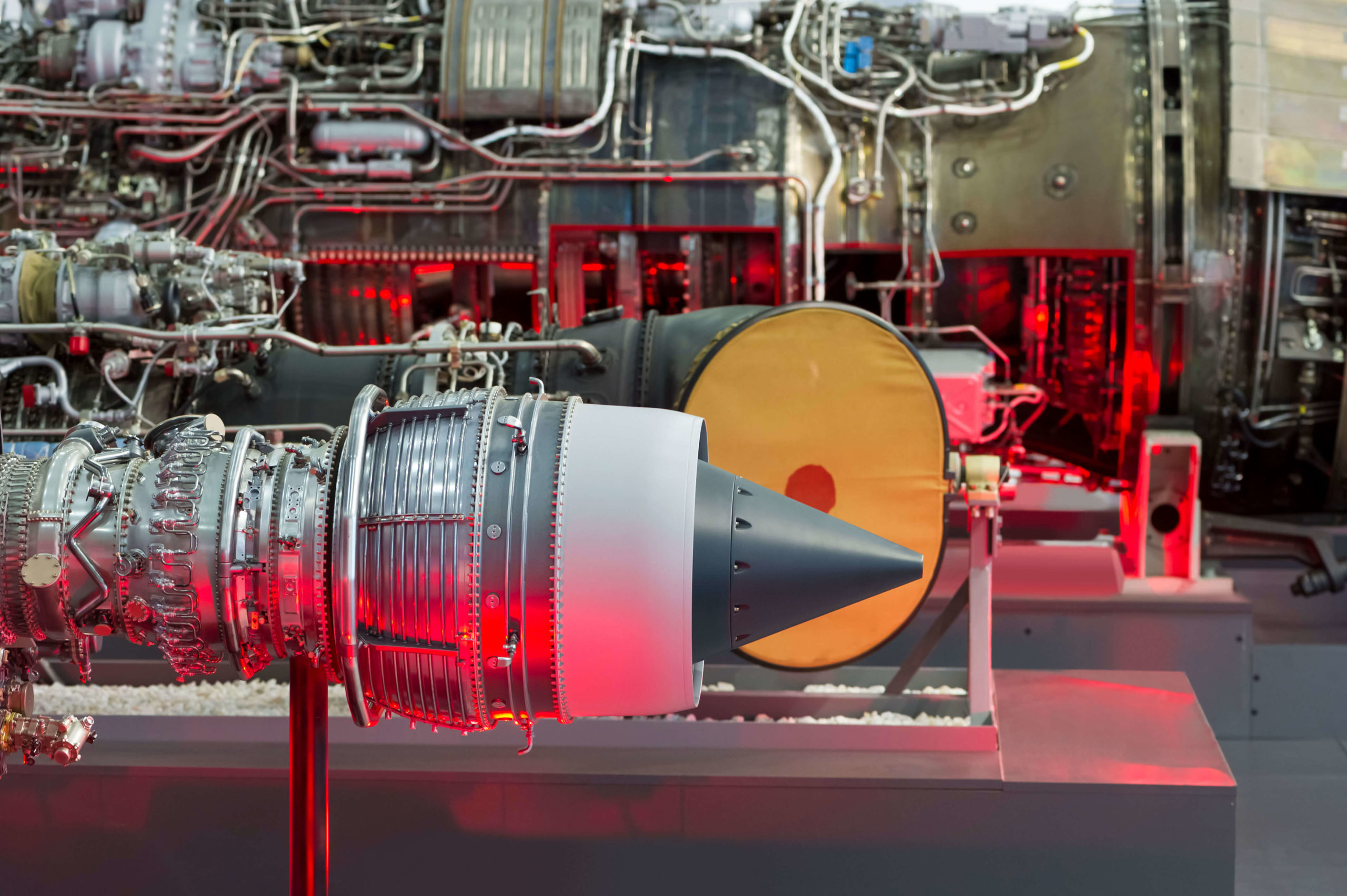

Energy Transition

,Critical Infrastructure Machinery

,Bethlehem, PA

,Active

Leading provider of specialty engineered aftermarket solutions for critical turbomachinery infrastructure

Aerospace & Defense

,Specialized A&D Systems

,USA - West

,Westminster, CO

,Active

Global leader in specialized aerospace systems and components

Team

Our micro-functional organizational structure is built for precision and speed. Expert teams across research, business development, underwriting, and value creation operate as an integrated system— driving institutionalized sourcing, systematic research, and consistent execution.